Trade ideas and what I'll be watching in the week ahead (July 18-24, 2021)

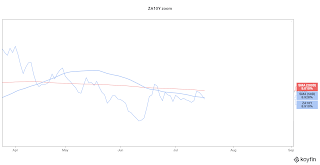

1. South African 10 yr- This trade isn't very sophisticated. Basically the currency sold off in the wake of the unrest that has swept the country since the arrest of former President Zuma. A lot of this probably by locals as a kind of insurance to protect themselves from a serious breakdown. These kind of sell-offs tend to overshoot from long-term fundamentals becuase of this impulse from locals to convert a portion of their savings into safer currencies & when things calm down the currencies will revert to trend. The sell-off was completed by Wed, and the ZAR has since recovered > 60% of what it gave up during the sell-off. Yet, it is still nearly 40 bp off its 50d so I'm in no rush to sell. Taking a look at the charts both the 10 yr & 30 yr have recovered back to their 50d but both are still quite a ways off from where they were two weeks ago just prior to the sell-off. I still really like the 10 yr here when it's yielding 8.9% before levering it up with considerable headwinds remaining w/ the currency.

Tickers: ZA10Y, ZA30Y, USD/ZAR Duration: < 3 months

2. Mexican FI & Peso- Coming into the year the narrative was that Mexico was positioned to benefit from the change in the WH and a cooling of trade tensions (a narrative that didn't really make sense to me; US cooling its trade ties w/ the EU, Japan, SK, Taiwan, Vietnam, & obviously China would only serve to strengthen US trade ties w/ Canada & Mexico but I digress). It's come to pass that the US has cooled trade feuds w/ the EU & has seemingly picked fights w/ its NA partners recently kind of validating my read on the matter (more on this later). Anyways, the Mexican 10 yr has been pretty much flat since the beginning of the year (skipping out on the volatility we've seen in the US space) & the peso pretty much has been as well. This has been the case despite pretty underwhelming economic data thus far. The CA in the first quarter came in at 5 billion in the red, a whopping miss from the 10 billion surplus consensus. The balance of trade figures (which is admittedly an inferior metric since it excludes MXN owned assets held abroad but is updated monthly instead of quarterly) has come in under consenus in 3 of the last 4 months and is on pace to be negative for the year. My read on the matter is that investors are being complacent on the good news that Mexico finally reversed its oil production decline & impressive remittance figures. That oil has such a good run in '21 thus far has certainly helped as well. But I do anticipate that a couple negative headlines over the past week could result in a shift in the narrative and investor appetite for Mexican assets and then three key developments could result in underperformance in the months ahead. First, the negative headlines concern the OPEC+ agreement unleashing more supply on the market, the gov deciding to award Pemex the exclusive rights in a new oil promising oil field, and this https://ajot.com/news/u.s-clashes-with-mexico-canada-on-car-rules-in-usmca-risk. The three developments that concern me are the following: 1) The delta variant. We've seen covid cases rise wherever the delta variant has spread in recent weeks. This has been the case wherever the delta variant has been introduced, including in the EU, US, and Canada which all have much higher rates of vaccination than Mexico. The only nation which had delta contagion without much of the population vaccinated is India and it suffered terribly. With the Delta variant spreading in the US it's only a matter of time before it is unleashed in Mexico. Thus far Mexico has experienced a modest rise in cases relative to the US. I fear that Mexico could suffer a nasty wave in Sep-Oct after two months of elevated travel from the US during the peak travel season. 2) Continued underperformance in the balance of payments. The case for bearishness in crude is a stronger case than bullishness over the remaining of '21 and any kind of new wave of covid cases spreading in Mexico will result in factory shutdowns. A worsening balance of payments should put pressure on the peso. 3) Drought/food prices. This is definitely a story I will be keeping close attention to in the latter half of the year. Brazil experienced a terrible harvest season for its soybean and coffee crop. It has been a wet July here in my neck of the woods in the gulf coast but the west coast of the US has seen a horrible heat wave and if harvests are weak at the end of summer we can see some pretty substantial price increases across a wide swath of consumer staples. I am calling for an underweight position on Mexican assets over the coming months in light of these developments. Unfortunately, there is no really good pair to match w/ Mexico and I have no interest in just going outright short Mexican bonds and paying the interest. I'm thinking of pairing my Mexico short buy pairing it w/ 10 yr bonds from Russia & Nigeria. They certainly are not perfect matches and they each carry their own shortcomings. But they at least offer protection from continued strong performance from oil boosting mexican assets. I do like going short mxn/cad but I aim rather conservative on the currency pairs in my p.a. because of the embedded leverage.

Tickers: MX10Y, USD/MXN, MXN/CAD Duration: 6-9ish months

3. Peru, Chile- These have been terrific assets to own in '21 to capitilize on the the global recovery coming out of the Covid recession. Influenced by the likes of Naufal Sanaullah and Jeff Curie I do think there is something to policy makers really leaning into employing fiscal support and addressing income inequality will result in a much healthier global recovery than what we experienced coming out of the GFC via much higher consumption in developed economies. And that this will lead to a boom in the commodity exporters. Chile & Peru have been excellent performers thus far. The recent protests in Chile are obviously worth keeping a close eye on but they do not concern me thus far. I actually think that constitutional changes that aim to address wealth inequality and aim to change how the mining sector is taxed by the state if anything is slightly bullish for holders of government debt. But that is not on the horizon for the time being. The thing to watch is food prices. Food prices can have a nasty effect on stability. I am keeping a close eye to make sure we don't see a repeat of 11-12. Negative headlines on disappointing harvests and rising inflation would result in me pairing back my position.

Obligatory mentions for a weekly summary

Argentina- Because I'll always be watching Argentina. The stories that have caught my eye over the past two weeks have been the backtracking on the ban on food exports and the inflation data. I'm assuming we'll continue to hear about ongoing discussions w/ the IMF over restructuring but I don't see it happening before the elections in Nov.

Lebanon- Situation only growing more dire. I'm keeping my google alerts on hoping for the best but there isn't much hope on the horizon.

El Salvador- I have to mention that I'll be keenly watching El Salvador as it embarks on this crazy experiment and observing it in a eyes covering my face but can't look away horror. It's not difficult to imagine a scenario where bad money drowns out all the good money and the state is cleaned out of its USD. Of course I'm hoping this very much doesn't come to pass. But I'm by no means certain that it won't.

Comments

Post a Comment